The Independent

Underwriter

for The Independent

AgentSM

property owners with secure title insurance.

We’re On Your Side

Alliant National has no direct operations to compete against independent agents like the big underwriters, so we can dedicate all our resources to helping independent agents thrive.

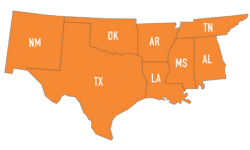

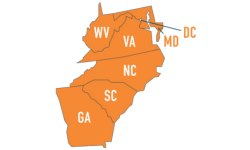

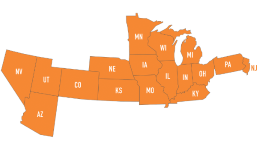

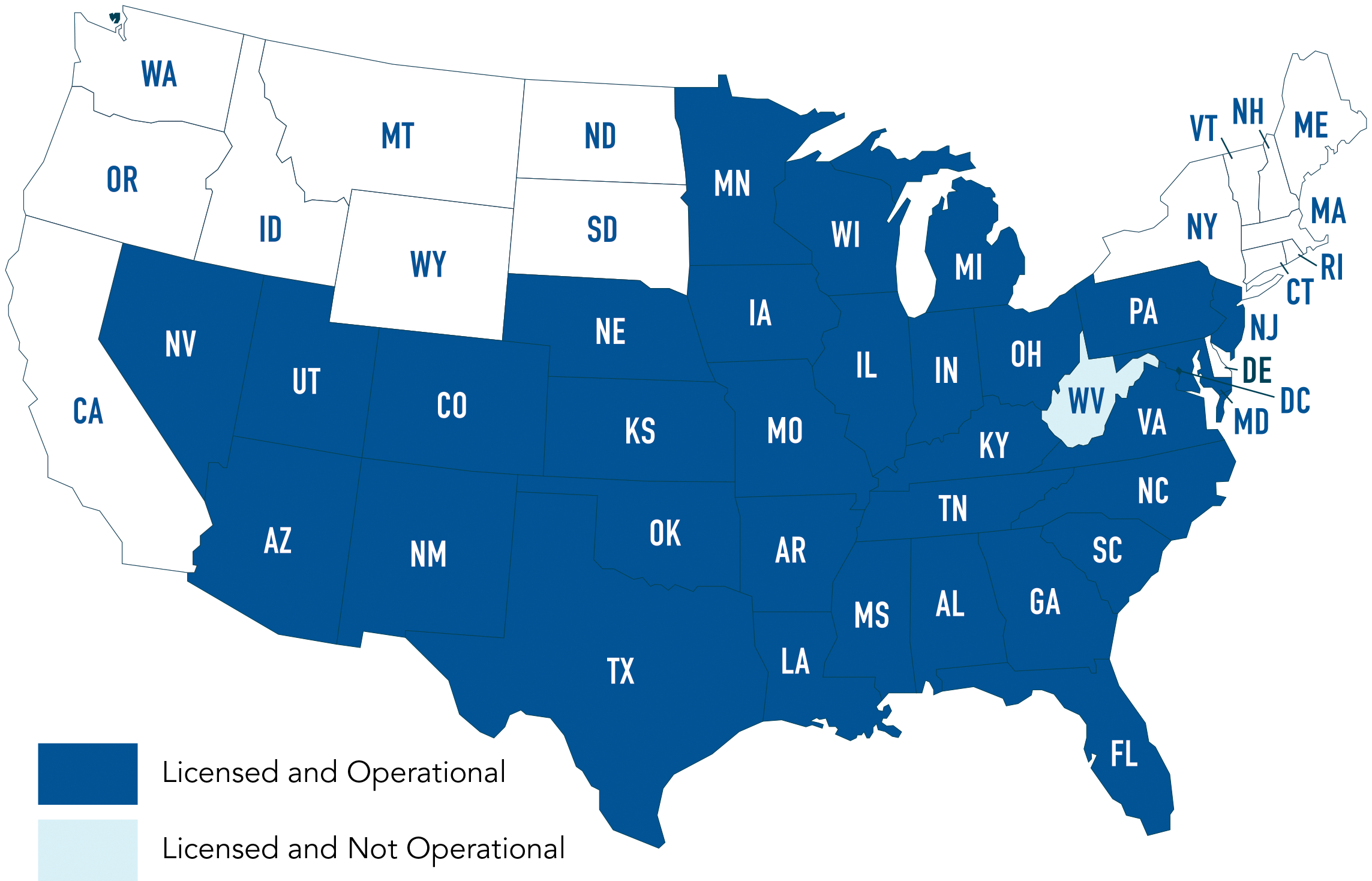

Where We Operate

MEET THE TEAM

Executive Team

EMAIL DAVID

EMAIL RODNEY

EMAIL MARGARET

| The Alliant National Way

Every independent agent aspires to be a partner

with Alliant National

3Cs: Culture of Trust

1. Competence we continue to develop our competence - pursue mastery, share our knowledge and continue to learn;

2. Caring we demonstrate care for others by being genuine, patient and uncommonly helpful;

3. Commitment we keep our commitments by setting expectations, doing what we say, and accepting unconditional responsibility for the outcomes we produce.