Financial Strength and Stability You Can Rely On

No title insurance underwriter can provide better protection for your title risk than Alliant National.

Alliant National has the financial strength, stability, and risk management that lenders can depend on. We have unsurpassed reinsurance, strong and exceptional recommendations from Demotech, effective vendor management and third-party controls as evidenced in our annual SOC 1 Type 2 independent audits. We maintain robust controls to protect Nonpublic Personal Information, Personally Identifiable Information, and sensitive data, that are independently validated with our ISO 27001 and ISO 27701 certifications, covering data privacy and security.

The bottom line: No title insurance underwriter can provide better protection for your title risk than Alliant National.

Lender Tools

Unsurpassed Reinsurance

Our conservative approach to protecting our policy holders is realized through reinsurance agreements with Lloyd’s of London. All seven of our reinsurance partners in London have an AM Best rating of A (Excellent) or better.

Your Trusted Partner

Enterprise Risk Management (ERM) Framework

The ERM is a systemic approach to identifying, reviewing, and mitigating both strategic and tactical risks. It is updated quarterly and reviewed by the Executive Team and BoD. The ERM covers both internal, external, financial, technical, operational, and reputational risks facing the company along with identified mitigation actions that addresses the risks.

Our SSAE 18 – SOC1 Type 2 annual audits independently validate the effectiveness of our controls, including vendor management, corporate governance, security, and agent quality management and our risk assessment programs.

27001 and 27701 Certified

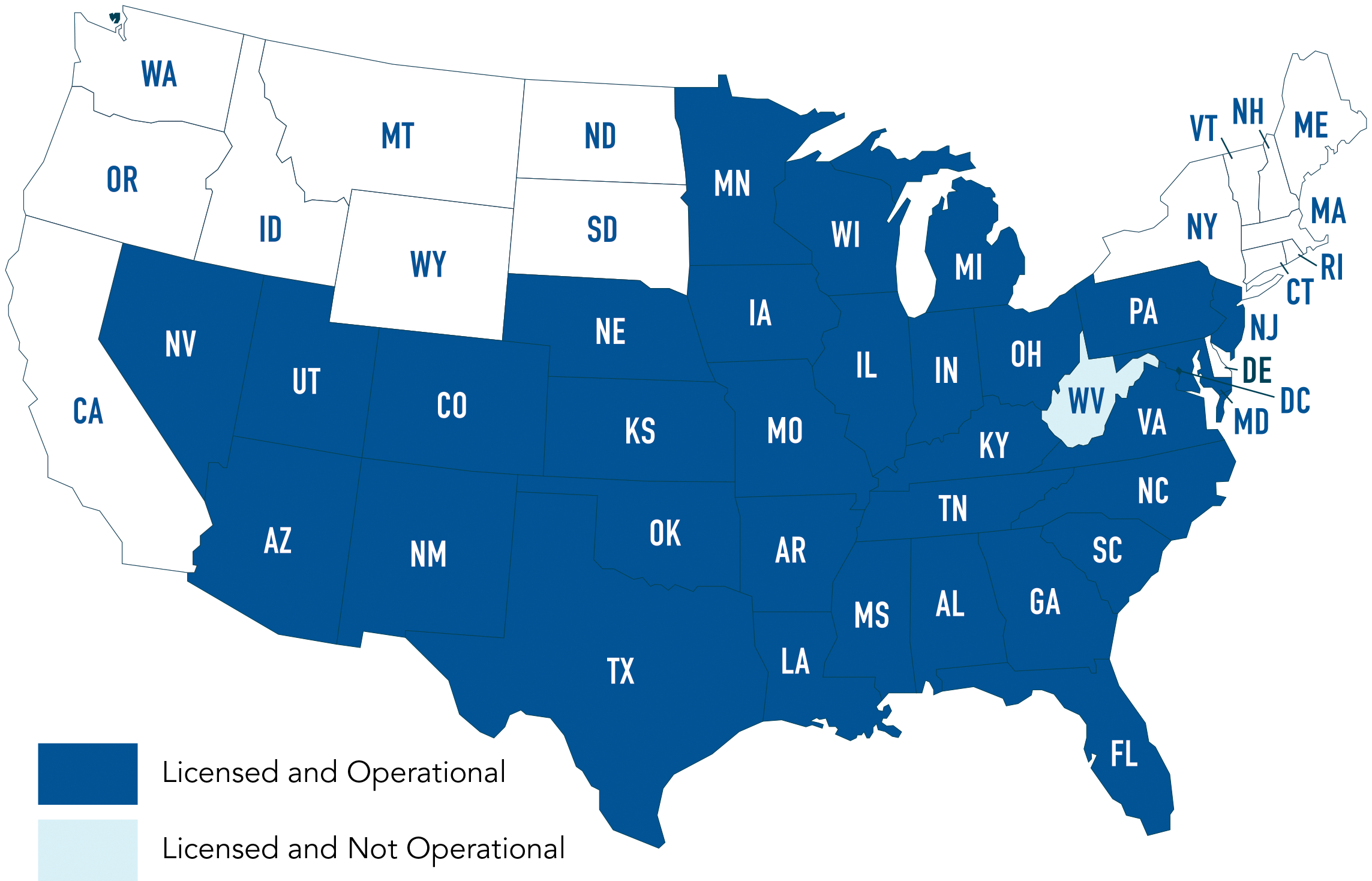

Let's start collaborating in your state!

Alliant National serves thousands of title professionals as a licensed underwriter in 32 states and the District of Columbia. Our team covers five regions, with corporate headquarters in Longmont, Colorado.

Sharing knowledge for better business

Get in Touch!

VP Risk Management and Data Privacy

Society for Quality (ASQ®) Member

Association of Certified Fraud Examiners (ACFE®) Member

e:

Email Tom

p:

303.682.9800

x

530