Hansen’s hiring further deepens Alliant National’s already strong underwriting capabilities in the region Longmont, CO — (May 15, 2025) — Alliant National Title Insurance Company, the title insurer that is uniquely responsive to the needs of independent agents, is happy to announce that it has added Jodi Hansen to its Florida underwriting team. Hansen brings extensive experience to Alliant National, …

Alliant National Welcomes Lori Ellen Ward as Underwriting Counsel, Florida Region

With nearly three decades “in the trenches” as a title agent, Lori will apply her expertise to empower the underwriter’s independent agents throughout Florida. Longmont, CO — (March 21, 2025) — Alliant National Title Insurance Company, the title insurer that is uniquely responsive to the needs of independent agents, is pleased to announce that it has hired Lori Ellen Ward as …

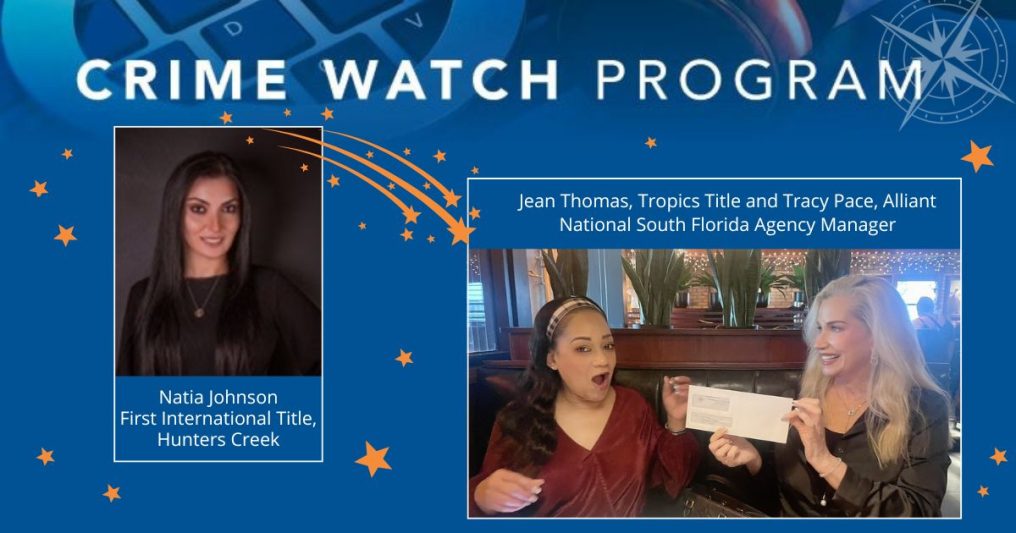

Two Alliant National Agents Take the Fight To Fraudsters

Alliant National agents are proving to be a valuable vanguard against real estate crime Although 2025 is barely a quarter old, independent agents have already been hard at work detecting, deterring and preventing fraudulent activity. At Alliant National, we’re proud to support these anti-fraud efforts through our Crime Watch program, which incentivizes agents with $1,000 rewards to be extra vigilant …

Valerie Grandin Joins Alliant National as VP, Senior Underwriting Counsel Florida

Longmont, CO — (October 16, 2024) — Alliant National Title Insurance Company, the title insurer that is uniquely responsive to the needs of independent agents, is excited to announce that it has hired Valerie Grandin as Vice President, Senior Underwriting Counsel Florida. Grandin brings with her a wealth of experience in title insurance, real estate, management and business strategy. She comes …

An Extraordinary Garden is Built

The bereaved find unexpected and welcome comfort Losing a child is a tragedy no parent should ever have to endure. While there are few words and even fewer comforts to be offered to those who have experienced such a loss, the team at The Compassionate Friends is doing its best to be there in the face of the unthinkable. Sandra …