#AllNatAdvantage

Sharing knowledge for better business

Latest Posts:

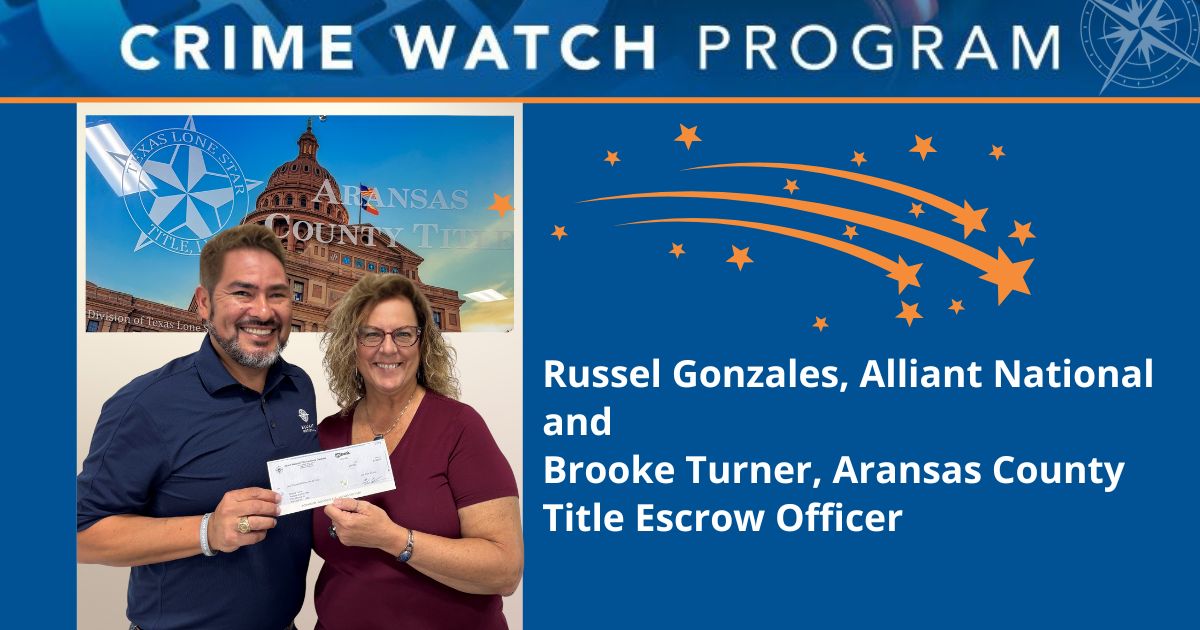

Texas Title Agent Spots Red Flags, Stops Dubious Deal

Aransas County Title recently stopped a fraudster cold and became the latest Alliant National Crime Watch recipient By Adam Mohrbacher…

Safeguard Your Brand’s Reputation With AI

Your brand’s reputation is everything; AI can ensure it stays secure By Adam Mohrbacher It will probably come as no…

Do You Have A Shadow IT Problem? Here’s Why You Need A Plan

Even when there is no malicious intent, unsanctioned applications can cause major problems for your agency By Bryan Johnson, IT…

Ready or Not: Preparing for the FinCEN Final Rule

By Elyce Schweitzer, Esq., Regulatory Compliance Officer, Alliant National; andValerie J. Grandin, Esq., Sr. Underwriting Counsel Florida and Vice President,…

Fraud:

Texas Title Agent Spots Red Flags, Stops Dubious Deal

Aransas County Title recently stopped a fraudster cold and became the latest Alliant National Crime Watch recipient By Adam Mohrbacher…

Do You Have A Shadow IT Problem? Here’s Why You Need A Plan

Even when there is no malicious intent, unsanctioned applications can cause major problems for your agency By Bryan Johnson, IT…

Marketing Tips:

Safeguard Your Brand’s Reputation With AI

Your brand’s reputation is everything; AI can ensure it stays secure By Adam Mohrbacher It will probably come as no…

How Smart Automation Can Strengthen Your Brand

Increase your brand’s impact through the power of AI As the AI era has unfolded, there has been no shortage…

Press:

Alliant National Welcomes Jodi Hansen as Florida Underwriting Counsel

Hansen’s hiring further deepens Alliant National’s already strong underwriting capabilities in the region Longmont, CO — (May 15, 2025) — Alliant…

Alliant National Welcomes Kelly Kinsey To Its Texas Team

Kinsey’s addition will strengthen Alliant National’s title production processes in the region Longmont, CO — (April 10, 2025) — Alliant National…