#AllNatAdvantage

Sharing knowledge for better business

Latest Posts:

Alliant National Adds Michelle

Garber will assist the underwriter’s agents in navigating complex title issues with confidence. By Adam Mohrbacher Longmont, CO. — (June 20,…

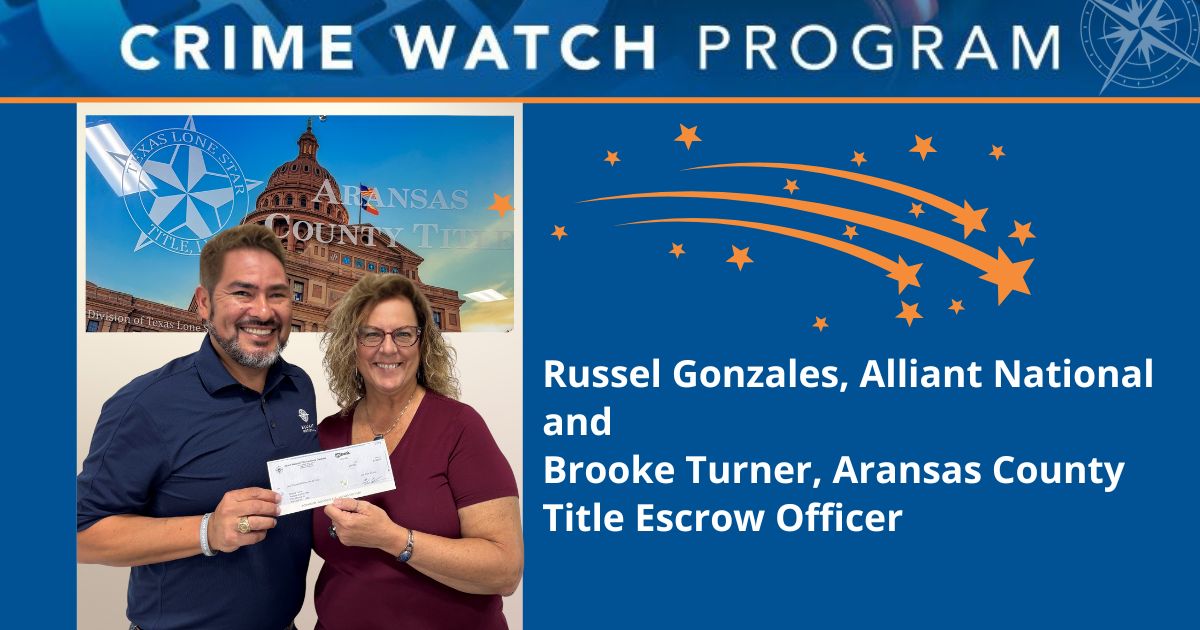

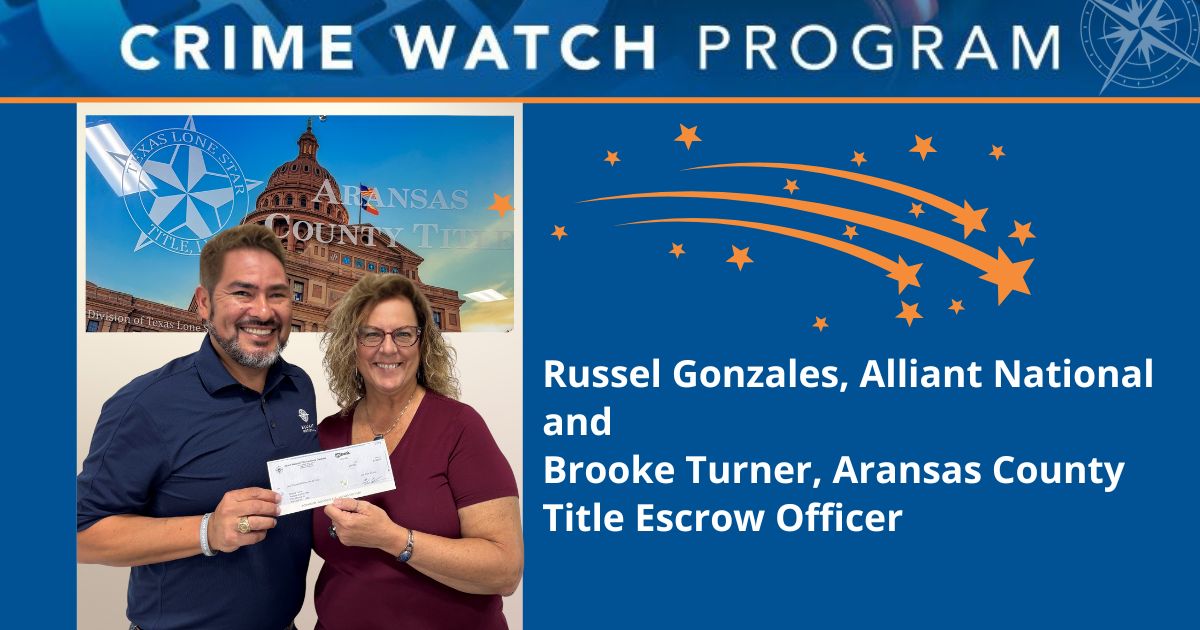

Texas Title Agent Spots Red Flags, Stops Dubious Deal

Aransas County Title recently stopped a fraudster cold and became the latest Alliant National Crime Watch recipient By Adam Mohrbacher…

Safeguard Your Brand’s Reputation With AI

Your brand’s reputation is everything; AI can ensure it stays secure By Adam Mohrbacher It will probably come as no…

Do You Have A Shadow IT Problem? Here’s Why You Need A Plan

Even when there is no malicious intent, unsanctioned applications can cause major problems for your agency By Bryan Johnson, IT…

Fraud:

Texas Title Agent Spots Red Flags, Stops Dubious Deal

Aransas County Title recently stopped a fraudster cold and became the latest Alliant National Crime Watch recipient By Adam Mohrbacher…

Do You Have A Shadow IT Problem? Here’s Why You Need A Plan

Even when there is no malicious intent, unsanctioned applications can cause major problems for your agency By Bryan Johnson, IT…

Marketing Tips:

Safeguard Your Brand’s Reputation With AI

Your brand’s reputation is everything; AI can ensure it stays secure By Adam Mohrbacher It will probably come as no…

How Smart Automation Can Strengthen Your Brand

Increase your brand’s impact through the power of AI As the AI era has unfolded, there has been no shortage…

Press:

Alliant National Adds Michelle

Garber will assist the underwriter’s agents in navigating complex title issues with confidence. By Adam Mohrbacher Longmont, CO. — (June 20,…

Alliant National Welcomes Jodi Hansen as Florida Underwriting Counsel

Hansen’s hiring further deepens Alliant National’s already strong underwriting capabilities in the region Longmont, CO — (May 15, 2025) — Alliant…