Alliant National agents are proving to be a valuable vanguard against real estate crime

Although 2025 is barely a quarter old, independent agents have already been hard at work detecting, deterring and preventing fraudulent activity. At Alliant National, we’re proud to support these anti-fraud efforts through our Crime Watch program, which incentivizes agents with $1,000 rewards to be extra vigilant when closing transactions. Two suspicious transactions at two different title agencies recently highlighted why this is a powerful approach to combating fraud. The agents collectively averted almost $300,000 in proposed liability. Let’s look at what happened and the lessons we can glean from their experience to keep future transactions safe.

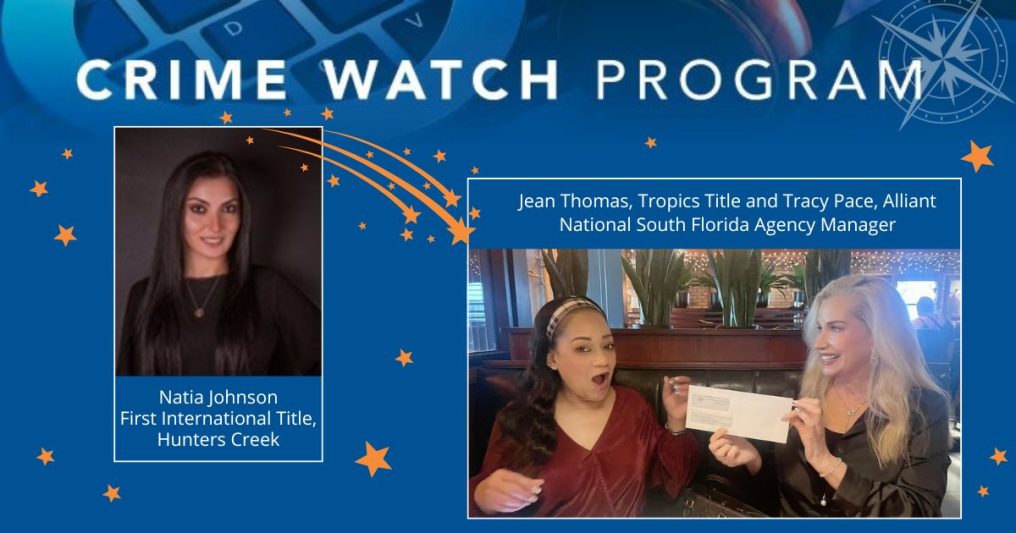

Fighting fraud at First International Title

Florida-based First International Title, Hunter’s Creek, recently prevented a suspicious transaction from going forward and protected its customers from financial loss. Escrow Officer Natia Johnson, who played a key role in stopping the bogus deal, shared with Alliant National how her office became aware the deal was likely fraudulent. The first red flag had to do with the transaction’s seller, who purported to be a dual U.S. and U.K. citizen living in the United Kingdom. By the time Johnson began working on the file, there had been no direct communication between the seller and her realtor. The two individuals had, instead, connected almost exclusively through a third party, who claimed to be an associate of the seller. When Johnson attempted to connect with this third party via email, she received no response.

The situation took an even stranger and more suspicious turn when the third-party representative called First International and told Johnson he was with the alleged seller in London. During the call, Johnson pushed to speak with the seller directly, yet this conversation only raised her level of concern. “She confirmed that her Social Security number was issued in 2007 and mentioned she is a naturalized citizen with dual citizenship,” said Johnson. “However, she also stated she does not have a current driver’s license or state ID, which is unusual.” Adding to the confusion, the seller provided the name and number of her supposed husband, who needed to also sign the deed. Yet he proved to be unreachable despite repeated calls from Johnson.

Johnson shared her concerns with her client, and that’s when the biggest red flag emerged. “I contacted our client to update them on the situation,” she said. “They mentioned Leonard had been present at the property just the day before and was reportedly still in the U.S. I asked, perhaps, if he flew to London just recently, but they stated ‘no, he is in Florida.’”

While all this was going on, further discrepancies were discovered with some of the seller’s documents. Their passport’s signature didn’t match the mortgage documents, which helped Johnson make her final judgement call. “This inconsistency, combined with the others, raised significant concerns about the authenticity of this transaction,” she said.

Tropics Title: Ensuring trustworthy transactions

Tropics Title Services is a second Florida-based firm that was recently recognized for its fraud fighting efforts. Regional Marketing Director Jean Thomas was immediately suspicious when a transaction came across her desk that was a vacant land deal, a cash purchase, involved foreign sellers, and included an urgent buyer—all quintessential hallmarks of fraud.

Not wanting to overstep the transaction’s agent, Thomas first reached out to the rest of her team and informed everyone what was going on. She next connected with the agent, who informed her that she had only communicated with the seller through email, which was another red flag. She then worked with her colleagues to request copies of the seller’s documents, which appeared inauthentic.

With suspicions mounting across Tropics Title, the team decided to place the transaction on hold until they could further verify the identities of those involved. Thomas reached out to Alliant National for help running further checks with the underwriter’s identity verification and fraud prevention tool, SecureMyTransaction. The link was promptly emailed out, but when the agency received no response after three attempts, it was concluded that the deal was likely fraudulent and should be canceled.

Collective effort is key to anti-fraud success

Whenever attempted fraud is discovered and prevented, it naturally provokes a range of reflections and reactions. For Johnson and First International Title, it reaffirmed how agents and agencies can’t afford to leave any stone unturned if something feels off during a transaction. “It was a stressful but rewarding experience,” she said. “It reinforced the need for vigilance, vigorously questioning any anomalies and, ultimately, trusting your instincts.”

Thomas and the rest of the Tropics Title team felt similarly. “I was relieved that I followed my gut, adhered to best practices and followed our tried-and-true policies for dealing with suspicious activities,” Thomas reflected. “Fraud is not going away in this industry, unfortunately,” she continued. “We must ensure that we thoroughly investigate any deals that carry sufficient red flags.”

Agencies, of course, should not be alone in this ongoing fight against fraud. The problem is a collective one, and therefore, mitigating it also requires a collective, collaborative effort between underwriters and agencies.

Whether it be with its Crime Watch program or by providing cutting edge tools like SecureMyTransaction, Alliant National is committed to being part of that solution. Johnson put it best perhaps when asked about how such programs can help the industry: “They can prevent fraud, protect homeowners and lenders, and safeguard transactions from financial and legal risks.”

Want to learn more about how you can leverage SecureMyTransaction at your agency? Start here. And if you’d like to discover how you can take part in our Crime Watch program, follow this link for additional information.