Here’s how Ellis County Title became Alliant National’s latest Crime Watch award winner

For Chelsa Holder, Director of Escrow Operations for Ellis County Title Company, something felt “off.”

The seasoned title professional was working with a seller’s son on a transaction. The son had submitted a Power of Attorney (POA) to authorize the property’s sale. His pushy behavior, however, had unnerved the escrow assistant who was also working on the same file, which prompted Holder to investigate. “The agent for the POA kept telling us how to do our jobs,” said Holder. “He was reluctant to provide key documents and details, and that behavior set off alarms with my team. I am super proud of them for bringing me this issue.”

Digging into the transaction’s details, it didn’t take Holder long to spot some red flags. As fate would have it, Holder knew the principal listed in the file, which enabled her to recognize that their signature didn’t quite match. “It was similar,” she recalled. “But I knew something was off, especially knowing she had experienced memory loss in recent years.”

Continuing her investigation, other worrying signs emerged, particularly when Holder looked at the notary stamp in the file. The notary listed on the POA had only become commissioned in May of 2024, several months after the POA had supposedly been executed in 2023. Furthermore, the notary lived in a county located nearly 300 miles away from Ellis County Title—which made it impossible that they could be the transaction’s legitimate notary.

Having long prioritized due diligence in her work, Holder took the initiative to track down the listed notary and gain further verification. She reached out to the notary on Facebook and had a lengthy conversation about the issue. The next day, the notary sent Holder a picture of their signature and stamp, which did not match what was listed in the POA and confirmed that the transaction was indeed bogus.

Holder and the notary reported the forgery to the Texas Secretary of State and local authorities. The team at Ellis County Title Company then halted the transaction and ultimately helped bring it to a secure resolution, with assistance from their underwriter, Alliant National.

Holder’s emotions around the case’s outcome were complicated to say the least. “I was on the edge of my seat,” said Holder, in thinking back on the experience. “I’m happy and sad at the same time. Happy that we were able to catch it but sad that people take advantage of other people.” According to Holder, the agent for the POA was trying to sell his mother’s house to provide her with funds, but he went about it the wrong way. “Eventually, we were able to close it with Alliant National’s help, and we were able to catch up with the seller at closing. She was happy that we assisted, understood why we needed to take the precautions we did, and she plans on making us lunch one day for us to all come visit her.”

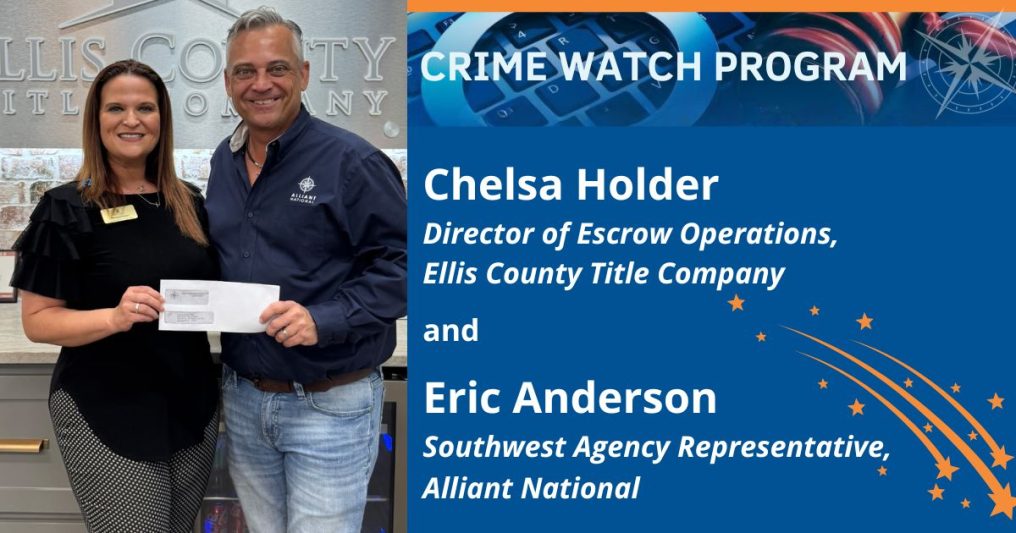

Alliant National was happy about the resolution as well, which is why we were pleased to recognize Holder as a Crime Watch award recipient. The Crime Watch program awards title professionals $1,000 when they successfully identify an instance of attempted fraud and prevent the transaction from going forward. This program has proven to be wildly successful, saving stakeholders hundreds of thousands of dollars annually and helping lower the cost of claims for the industry. Holder plans to donate her $1,000 award to TLTAPAC, the organization dedicated to promoting the Texas land title industry to members of the Texas Legislature and other elected leaders.

From her quick thinking and effective communication to her savvy investigatory skills, Holder could not have been a more deserving Crime Watch award recipient. Her story is an important one, showcasing how critical it is to trust your gut in a high stakes transaction and always double-check the details.

Want to learn more about Alliant National’s Crime Watch program? Find more information here.